Did you know that over 1.8 million NRIs are actively investing in the Indian stock market? Yet, thousands more are missing out on India's economic growth simply because they don't know how to start.

If you're living abroad and want to invest in Indian stocks, bonds, or mutual funds, you need an NRI demat account. Think of it as your digital vault that holds your investments electronically. Without it, you can't trade in the Indian stock market.

In this guide, you'll learn everything about opening an NRI demat account, from choosing between NRE and NRO accounts to comparing top brokers. You'll also discover the exact documents you need, step-by-step opening process, and common mistakes to avoid. Let's get started.

Key Takeaway

- NRI demat accounts come in two types: NRE (fully repatriable) and NRO (limited repatriation), and choosing the right one depends on whether you want to transfer funds abroad

- You'll need specific documents including PAN card, passport, visa, overseas address proof, and linked NRI bank account to open your account

- The account opening process takes 7-15 days and can be completed entirely online with video verification in most cases

- Top brokers like ICICI Direct, HDFC Securities, Kotak Securities, Zerodha, and Axis Direct offer NRI accounts with varying charges and features

- Understanding repatriation rules, tax implications, and FEMA compliance is crucial before you start investing

- Compare broker charges carefully as AMC fees range from Rs 0 to Rs 750, and brokerage can significantly impact your returns

What is an NRI Demat Account?

An NRI demat account is an electronic account that holds your shares, bonds, mutual funds, and other securities in digital format. Instead of receiving physical share certificates when you buy stocks, everything gets stored electronically in your demat account.

The term "demat" stands for dematerialized, which simply means converting physical certificates into electronic form. When you buy shares, they get credited to your demat account. When you sell, they get debited.

How it Differs from Resident Demat Accounts

NRI demat accounts work differently from regular resident accounts in several ways. First, you need to link your account to an NRI bank account (NRE or NRO), not a regular savings account. Second, you must comply with FEMA regulations that govern how much you can invest and repatriate.

Third, some investments have specific caps for NRIs. For example, you can't own more than 5% of a company's paid-up capital individually, and all NRIs together can't hold more than 10% (this can go up to 24% with company approval).

Role of CDSL and NSDL Depositories

In India, two depositories manage all demat accounts: CDSL (Central Depository Services Limited) and NSDL (National Securities Depository Limited). They act as the central record-keepers for all securities.

Your broker or bank acts as a depository participant (DP) who connects you to either CDSL or NSDL. When you open a demat account, you're actually opening it with a DP who maintains your records with one of these depositories. Both depositories are equally reliable and secure.

Who Can Open an NRI Demat Account?

NRI Definition Under FEMA

According to FEMA (Foreign Exchange Management Act), you're considered an NRI if you're an Indian citizen who stays outside India for more than 182 days in a financial year. This could be for employment, business, education, or any other purpose.

Your residential status determines what type of bank and demat accounts you can open. If you spend more than 182 days in India during a financial year, you're treated as a resident, not an NRI.

Eligibility Criteria

You can open an NRI demat account if you meet these conditions:

You must be an Indian citizen living abroad with valid proof of overseas residence. This includes your work visa, residence permit, or employment contract showing you're based outside India.

You need a valid PAN card. This is mandatory for all demat accounts in India, and there's no exception for NRIs.

You should have an NRI bank account (either NRE or NRO) that will be linked to your demat account. You can't link a regular resident savings account.

PIO and OCI Eligibility

Persons of Indian Origin (PIOs) and Overseas Citizens of India (OCIs) can also open NRI demat accounts. PIOs are foreign citizens with Indian ancestry, while OCIs are foreign citizens who were eligible to become Indian citizens.

Both PIOs and OCIs enjoy the same investment rights as NRIs in the stock market. They can open demat accounts, invest in stocks, and repatriate funds following the same rules that apply to NRIs.

Countries with Restrictions

Most countries allow their residents to open NRI demat accounts in India. However, if you're residing in countries identified by the Financial Action Task Force (FATF) as high-risk jurisdictions, you might face additional scrutiny or restrictions.

Some brokers may also have internal policies restricting accounts from certain countries due to compliance requirements. Always check with your chosen broker about country-specific restrictions before starting the application process.

What are the Types of NRI Demat Accounts?

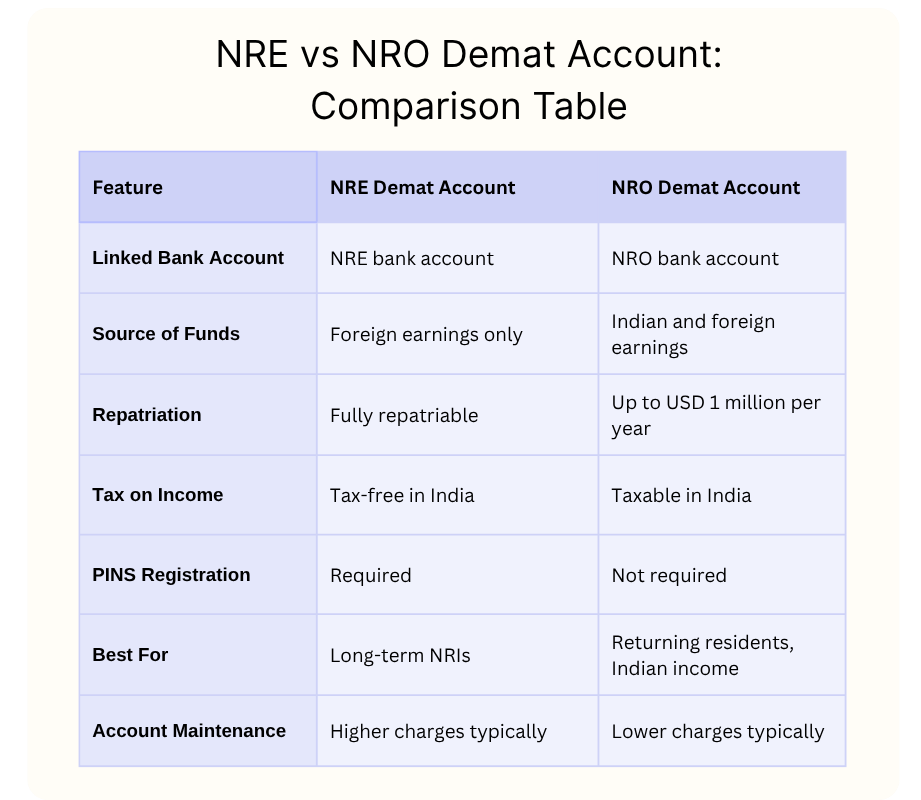

You have two main options when opening an NRI demat account: NRE and NRO. Your choice depends on whether you want to bring money back to your country of residence.

NRE Demat Account (PINS)

An NRE demat account is linked to your NRE bank account and operates under the Portfolio Investment Scheme (PINS). This is the popular choice for NRIs who want complete flexibility with their money.

The biggest advantage? Both your investment amount and any profits you make are fully repatriable. You can transfer all your money back to your foreign bank account without any limits (except the investment itself should be from foreign sources).

Your returns are also tax-free in India. Any interest or dividend earned in your NRE account doesn't attract Indian tax, though you'll need to pay taxes in your country of residence based on local laws.

Who Should Choose NRE Demat

Choose an NRE demat account if you plan to invest money from your foreign earnings and want the option to take everything back abroad. It's ideal if you're earning in foreign currency and want to invest surplus funds in India.

This account works best for NRIs who don't plan to return to India permanently in the near future and need access to their investments in their country of residence.

NRO Demat Account (Non-PINS)

An NRO demat account links to your NRO bank account and doesn't require PINS registration. You use this account to invest money that you've earned in India or from Indian sources.

With NRO accounts, you can repatriate up to USD 1 million per financial year after paying applicable taxes. However, this limit covers all repatriations from your NRO account combined, not just investment returns. Learn more about NRI fund repatriation rules.

The income you earn through NRO investments is taxable in India. TDS (Tax Deducted at Source) applies on dividends and capital gains as per Indian tax laws.

Who Should Choose NRO Demat

Choose an NRO demat account if you're investing money earned in India, like rental income, freelance payments, or pension. It's also suitable if you have savings in India from before you became an NRI.

This account makes sense if you plan to return to India eventually and want to build wealth here. The limited repatriation isn't a problem if you don't need to move large amounts abroad regularly.

For a detailed comparison of different NRI account types, check out our guide on NRE vs NRO vs FCNR accounts.

What Documents Do You Need to Open an NRI Demat Account?

Getting your documents ready beforehand speeds up the account opening process significantly. Here's exactly what you need.

Mandatory Documents Checklist

Your PAN card is non-negotiable. You need a clear, colored copy of your original PAN card. If you don't have a PAN card yet, you'll need to apply for one before opening a demat account.

For passport copies, submit colored scans of the first and last page, plus any page showing your current visa or immigration stamp. Make sure all pages are clearly visible and not blurry.

Your visa or work permit proves your NRI status. Submit copies of your current work visa, employment visa, residence permit, or student visa. If you have permanent residency in another country, that works too.

Provide two passport-size photographs taken within the last six months. Some brokers accept digital photos, while others need physical copies with your signature on the back.

You'll need an overseas address proof dated within the last three months. This can be a utility bill, bank statement, rental agreement, or government-issued ID with your foreign address.

For your Indian address, submit any one of these: Aadhaar card (learn more about Aadhaar for NRIs), voter ID, driving license, passport, or utility bill showing an Indian address.

Bank Account Documents

You must have an active NRI bank account (NRE or NRO) before opening a demat account. Submit a cancelled cheque or bank statement showing your account number, IFSC code, and your name.

If your bank doesn't issue cheques, a bank letter confirming your account details on their letterhead works. Some brokers also accept screenshots of your net banking showing account details.

The bank account must be in your name only. Joint accounts may not be accepted for linking with your demat account, so check with your broker beforehand.

Additional Documents for Specific Countries

If you're based in the USA, you might need to submit Form W-8BEN to claim tax treaty benefits under DTAA. This form declares your status as a foreign person for US tax purposes.

Some brokers require a tax residency certificate from your country of residence. This certificate proves where you pay taxes and helps in claiming benefits under Double Taxation Avoidance Agreements.

For certain high-risk countries, brokers may ask for additional KYC documents like employer letters, proof of source of funds, or bank statements from your foreign bank.

Document Attestation Requirements

Most brokers now accept self-attested document copies for NRI demat accounts. This means you can sign and date the copies yourself without needing notarization.

However, some traditional banks and brokers still require notarized or apostille-certified documents. Notarization by an Indian embassy or consulate in your country of residence is typically accepted.

For online account opening, you'll upload digital copies of your documents. The broker verifies these through video KYC, so keep original documents handy during the verification call.

How to Open NRI Demat Account Online? (Step-by-Step Process)

Opening an NRI demat account is easier than you think. Most brokers now offer completely online processes that you can complete from anywhere in the world.

Step 1: Choose the Right Broker

Start by comparing brokers based on charges, platform quality, customer support, and features for NRIs. Look at account opening fees, annual maintenance charges, and brokerage rates.

Check if the broker offers a good mobile app with international access. You'll be managing your investments from abroad, so a reliable app with global support is essential.

Read reviews from other NRIs about their experience with customer service. Issues like delayed support or difficulty reaching the helpdesk can be frustrating when you're in a different time zone.

Step 2: Select Your Account Type (NRE or NRO)

Decide whether you need an NRE or NRO demat account based on your fund source and repatriation needs. If you're confused, most brokers provide free consultation to help you choose.

Remember, you can open both types of accounts if you have both foreign earnings and Indian income. However, maintaining two accounts means paying AMC for both.

Step 3: Gather Required Documents

Collect all documents mentioned in the previous section. Scan them in high resolution (at least 300 DPI) in PDF or JPEG format. Ensure all text is clearly readable.

Name your files properly, like "Passport_FirstLast_Page.pdf" or "Visa_Copy.pdf". This makes the upload process smoother and reduces back-and-forth with the broker.

Step 4: Fill Online Application Form

Visit your chosen broker's website and find the NRI account opening section. Fill in personal details, contact information, and banking details carefully.

Double-check your PAN number, email address, and phone number. These will be used for all future communications and OTP verification.

Select your trading preferences, whether you want equity, derivatives, commodities, or currency trading. You can modify these later, but it's easier to set up everything during account opening.

Step 5: Complete In-Person Verification (IPV)

Video KYC has made this step convenient for NRIs. Schedule a video call with the broker's verification team at a time that suits your time zone.

During the call, keep your original documents ready. The executive will verify your identity, check documents, and record the session as per SEBI guidelines.

Make sure you're in a well-lit room and have stable internet connection. The entire process takes about 10-15 minutes.

Step 6: Submit Documents and Agreement

Upload all required documents through the broker's portal. Most platforms have clear sections for each document type with file size and format specifications.

Sign the client agreement digitally using e-sign or Aadhaar-based authentication. This agreement outlines your rights and responsibilities as a client and the broker's obligations.

Some brokers might require you to courier physical documents with wet signatures. Check their requirements during the application process to avoid delays.

Step 7: Activate Your Account

Once your documents are verified, you'll receive your demat account number (usually 16 digits starting with IN). This typically takes 2-7 business days after document submission.

Your trading account and demat account get activated simultaneously. You'll receive login credentials for the trading platform via email and SMS.

Link your NRI bank account for fund transfer. Most brokers allow instant account linking through net banking, or you can submit a cancelled cheque.

Timeline: How Long Does It Take?

The entire process typically takes 7-15 business days from application to activation. This includes document verification, account opening, and linking with your bank account.

Video KYC significantly speeds things up compared to the traditional in-person verification. If you courier documents internationally, add another 5-7 days for delivery and processing.

Some digital-first brokers like Zerodha and Upstox can activate accounts within 24-48 hours if all documents are in order and video KYC is completed smoothly.

What are the Requirements for Opening an NRI Demat Account?

Beyond just documents, you need to meet certain regulatory and operational requirements to open and maintain an NRI demat account.

FEMA Compliance Requirements

All NRI investments fall under FEMA regulations. You must invest through proper banking channels only. This means transferring money from your foreign bank account to your NRI account, then to your trading account.

You cannot invest using funds from resident Indian friends or family. Such transactions violate FEMA rules and can lead to account suspension or penalties.

Maintain proper documentation of fund sources. If authorities ask, you should be able to prove that your investment money came from legitimate foreign sources or repatriable Indian income.

RBI Guidelines to Follow

The Reserve Bank of India sets investment limits for NRIs. Individually, you can't buy more than 5% of a company's paid-up capital. Collectively, NRIs can't hold more than 10% (extendable to 24%).

You're also restricted from buying shares of companies in certain sectors. For example, NRIs generally cannot invest in agricultural land or plantation property companies without special permissions.

Your investments must be reported to RBI if they exceed certain thresholds. Your broker usually handles this reporting, but you should be aware of this requirement.

SEBI Regulations for NRI Trading

SEBI mandates that all NRI accounts must be opened under the Portfolio Investment Scheme. This applies to NRE demat accounts and ensures proper monitoring of foreign portfolio investments.

You need to appoint the depository participant (your broker) as your custodian for PINS accounts. They'll handle reporting and compliance on your behalf.

SEBI also requires that all transactions happen through recognized stock exchanges. You cannot trade directly with other individuals or in unofficial markets.

Linked Bank Account Requirements

Your demat account must be linked to an NRI bank account only. You cannot link regular resident savings accounts, even if you still have them in India.

The bank account and demat account should be in the same name. If you have a joint demat account, the linked bank account must also be joint with the same holders.

Some brokers require that the linked bank account be with a specific list of banks. Check this before opening your NRI bank account to avoid complications later.

Minimum Balance or Deposit Requirements

Most brokers don't have a minimum deposit requirement for opening NRI demat accounts. However, you'll need sufficient balance to pay account opening charges if applicable.

For trading, you'll need to maintain a minimum balance in your trading account. This varies by broker and depends on the types of trades you want to place. For equity delivery, even Rs 10,000 can be enough to start.

Some brokers waive AMC (Annual Maintenance Charges) if you maintain a certain trading volume or account balance. Ask about such offers when opening your account.

Which are the Top Brokers for NRI Demat Accounts in India?

Choosing the right broker is crucial for a smooth investment experience. Here are the top brokers offering NRI demat accounts in India:

Full-Service Brokers:

- ICICI Direct

- HDFC Securities

- Kotak Securities

- Axis Direct

- Sharekhan

- Motilal Oswal

- Angel One

Discount Brokers:

- Zerodha

- Upstox

- Groww

- 5paisa

- Paytm Money

Bank-Backed Brokers:

- SBI Securities (SBISEC)

- IDBI Capital

- Kotak Securities

- ICICI Direct

- HDFC Securities

Each broker has different strengths. Full-service brokers offer research, advisory, and relationship managers but charge higher fees. Discount brokers have minimal charges but provide limited support. Bank-backed brokers offer convenience if you already bank with them.

How to Choose the Right Broker for Your NRI Demat Account?

Don't just pick a broker based on brand name. Your specific needs as an NRI investor should guide your decision.

Factors to Consider

Charges and fees structure matters more than you think. A broker charging Rs 20 brokerage per trade versus Rs 50 makes a huge difference over hundreds of trades. Calculate potential annual costs based on your expected trading frequency.

Trading platform quality is critical when you're managing investments from abroad. Test the mobile app and web platform during demo or trial periods. Check if they work smoothly in your country without VPN issues.

Research and advisory support varies dramatically between brokers. Full-service brokers provide detailed research reports, stock recommendations, and market analysis. If you're new to Indian markets, this support justifies the higher fees.

Customer service and support becomes crucial when you're in a different time zone. Check if the broker offers 24/7 support or at least support during your waking hours. Email response time is another good indicator of service quality.

International access and app quality should be non-negotiable. Ensure the trading app works flawlessly in your country. Some apps have geo-restrictions or require Indian SIM cards for OTP, which creates problems for NRIs.

Questions to Ask Before Opening Account

Can you access the platform from my country of residence? Some brokers restrict access from certain regions due to compliance issues.

What's your average response time for NRI queries? This tells you how seriously they take international clients.

Do you offer dedicated relationship managers for NRIs? Having a single point of contact makes problem resolution much faster.

Can I trade in all segments (equity, F&O, commodities, currency)? Some brokers restrict certain trading segments for NRI accounts.

What's the process for updating documents when my visa or address changes? This happens frequently for NRIs and should be hassle-free.

What are the Charges for NRI Demat Accounts?

Understanding the complete fee structure helps you avoid surprises and choose a cost-effective broker.

Account Opening Charges

Full-service brokers typically charge Rs 500 to Rs 1,000 as one-time account opening fees. This covers the cost of account setup, document verification, and initial support.

Discount brokers usually charge Rs 200 to Rs 500, or sometimes nothing. Zerodha, for example, charges around Rs 300 for NRI account opening.

Some brokers run promotional offers with zero account opening charges. However, check if they compensate with higher AMC or brokerage rates.

Annual Maintenance Charges (AMC)

AMC or Demat Annual Maintenance Charges range from Rs 0 to Rs 750 per year. This fee covers the cost of maintaining your demat account with the depository.

Discount brokers like Zerodha charge around Rs 300 AMC for demat accounts. Full-service brokers charge between Rs 500-750 annually.

Some brokers waive AMC if you maintain minimum trading volume or account balance. For example, trading 4 times a year or maintaining Rs 50,000 balance might waive the AMC.

Transaction Charges and Brokerage

Brokerage is what you pay on every trade. Full-service brokers charge 0.25% to 0.50% of transaction value, while discount brokers charge a flat Rs 10-20 per trade or 0.03% of transaction value, whichever is lower.

For a Rs 1 lakh transaction, a full-service broker charging 0.40% takes Rs 400, while a discount broker charges just Rs 20-30. This adds up significantly with frequent trading.

Beyond brokerage, you pay STT (Securities Transaction Tax), GST, exchange transaction charges, and SEBI turnover fees. These are standard across all brokers and add about 0.05% to 0.10% to your costs.

DP Charges (Debit Transaction Charges)

Every time you sell shares from your demat account, you pay DP charges. This typically ranges from Rs 5 to Rs 20 per scrip (not per share).

So if you sell shares of 3 different companies in one day, you pay DP charges 3 times. This is one reason why holding too many different stocks can increase costs.

DP charges don't apply when you buy shares or when you sell mutual funds. They only apply to selling equity shares, bonds, or ETFs.

Hidden Charges to Watch Out For

Some brokers charge for call and trade facility if you place orders by calling their helpdesk instead of using the app. This can be Rs 20-50 per trade.

Inactivity charges apply if you don't trade for several months. Some brokers charge Rs 50-100 per month if your account remains dormant.

AMC on trading account is separate from demat AMC. Some brokers charge Rs 200-300 annually for maintaining your trading account in addition to demat AMC.

Physical statement charges apply if you request printed statements instead of digital ones. Most brokers charge Rs 50-100 per statement request.

How to Minimize Costs

Choose discount brokers if you're comfortable with minimal support and basic trading needs. Your savings on brokerage alone can be 80-90% compared to full-service brokers.

Pay annual AMC upfront if offered at a discount. Some brokers give 10-20% off if you pay for multiple years together.

Use limit orders instead of market orders when possible. This gives you better control over execution prices and can save significant money on large trades.

Consolidate your holdings to reduce DP charges. Instead of holding Rs 10,000 each in 10 stocks, consider holding larger positions in fewer stocks if it fits your strategy.

What Can NRIs Invest in Through Demat Accounts?

Your NRI demat account gives you access to most Indian securities, but with some restrictions. Here's what you can and cannot invest in.

Permitted Investments

Equity shares are the most popular investment for NRIs. You can buy shares of any publicly listed company on BSE or NSE, subject to sectoral caps and individual limits.

Bonds and debentures from government and private companies are available. This includes tax-free bonds, infrastructure bonds, and corporate debentures. They offer fixed returns and lower risk compared to equities.

Mutual funds are a great way to diversify your Indian investments. NRIs can invest in equity funds, debt funds, hybrid funds, and ETFs. Learn more about how NRIs can invest in Indian mutual funds.

ETFs (Exchange Traded Funds) trade like stocks but give you diversified exposure. You can invest in Nifty ETFs, Gold ETFs, or sectoral ETFs through your demat account.

Government securities including Treasury Bills, Government Bonds, and State Development Loans are available. These are the safest investments with sovereign guarantee.

For comprehensive information on all available options, read our guide on NRI investment options in India.

Investment Restrictions for NRIs

NRIs cannot invest in certain types of securities. Small savings schemes like PPF, NSC, and Kisan Vikas Patra are not available to NRIs.

You're restricted from investing in chit funds, Nidhi companies, and other unregulated investment schemes. These fall outside FEMA-approved investment avenues.

Real estate investments have restrictions. While NRIs can buy residential and commercial property, they cannot buy agricultural land, plantation property, or farmhouses without special permissions.

NRIs generally cannot invest in partnership firms or proprietorship businesses in India, except through specific RBI-approved routes.

Sectoral Caps and Limits

Individual NRIs can hold up to 5% of paid-up capital in any Indian company. Beyond this, you need special approval from the company and regulatory authorities.

Collectively, all NRIs together can hold up to 10% of a company's paid-up capital. Companies can increase this limit to 24% by passing a board resolution and special resolution.

Some sectors have tighter restrictions. Defense, broadcasting, print media, and airlines have specific FDI caps that apply to NRI investments too.

Banking and insurance sectors have their own investment limits. For example, NRIs can own up to 10% individually in private banks, subject to regulatory approval.

What are the Repatriation Rules for NRI Investments?

Repatriation means moving your money from India to your country of residence. The rules differ based on your account type.

Repatriable Investments (Through NRE Account)

Investments made through your NRE demat account are fully repatriable. This means both your principal investment and all profits can be transferred abroad without any monetary limit.

When you sell shares in your NRE demat account, the sale proceeds automatically credit to your linked NRE bank account. From there, you can freely transfer funds to your foreign bank account.

You don't need RBI permission for repatriation from NRE accounts. Your bank handles the transfer following standard procedures. Just ensure you maintain proper documentation of the fund source.

For detailed information about moving money abroad, check our complete guide on NRI repatriation of funds.

Non-Repatriable Investments (Through NRO Account)

With NRO demat accounts, you can repatriate up to USD 1 million per financial year. This includes all repatriations from your NRO accounts combined - investments, rental income, pension, everything.

You need to pay applicable taxes before repatriation. This includes capital gains tax on stock sales and any other tax liabilities. Your CA must certify Form 15CA/15CB confirming tax compliance.

The USD 1 million limit applies per person, per financial year (April to March). If your spouse also has NRO accounts, they get a separate USD 1 million limit.

Annual Repatriation Limits

There's no annual limit for repatriation from NRE accounts. You can transfer any amount as long as it came from legitimate foreign sources or repatriable investments.

For NRO accounts, the USD 1 million annual limit covers all types of repatriation. This includes investment proceeds, sale of immovable property, gifts, inheritance, and income from Indian sources.

If you need to repatriate more than USD 1 million from NRO accounts, you need special RBI permission. This requires submitting detailed documentation and justification.

Documentation for Fund Transfer

For NRE repatriation, you need a Foreign Inward Remittance Certificate (FIRC) or bank statement proving the original investment came from abroad.

For NRO repatriation, you need Form 15CA and Form 15CB signed by a Chartered Accountant. These forms certify that all applicable taxes have been paid.

Keep your stock purchase and sale contract notes. Banks may ask for these to verify the nature of funds being repatriated.

A certificate from your broker stating the investment amount and current value helps. Some banks require this for repatriation above certain thresholds.

What are the Tax Implications for NRI Demat Account Holders?

Taxes can significantly impact your returns. Understanding the tax structure helps you plan better and avoid surprises.

TDS on Capital Gains

When you sell shares at a profit, you earn capital gains. NRIs face Tax Deducted at Source (TDS) on these gains at the time of sale.

The broker or bank deducts TDS before crediting sale proceeds to your account. The TDS rates are higher for NRIs compared to resident Indians.

For both short-term and long-term gains, TDS rates for NRIs are approximately 20% (plus applicable surcharge and cess) if PAN is provided. Without PAN, TDS jumps to 30%.

LTCG and STCG Tax Rates

Short-term capital gains (STCG) on equity shares held for less than 12 months are taxed at 20% for NRIs. For residents, it's 15%, but NRIs face higher rates unless they claim treaty benefits.

Long-term capital gains (LTCG) on equity shares held for more than 12 months are taxed at 12.5% for gains above Rs 1.25 lakh per year (as per current 2024-25 rules). NRIs can claim this benefit by filing their tax returns.

For debt instruments and non-equity investments, STCG is taxed at applicable slab rates, while LTCG is taxed at 12.5% with indexation benefit (for investments made before April 2023).

Get detailed information in our comprehensive guide on capital gains tax for NRIs.

Tax Treaty Benefits (DTAA)

India has signed Double Taxation Avoidance Agreements (DTAA) with over 90 countries. These treaties prevent you from paying tax twice on the same income - once in India and again in your country of residence.

Under DTAA, you can claim a lower TDS rate or tax credit in your home country for taxes paid in India. For example, the India-USA tax treaty allows capital gains to be taxed in the country of residence, not the source country.

To claim DTAA benefits, you need a Tax Residency Certificate (TRC) from your country's tax authorities. Submit this to your broker or bank to get lower TDS deduction.

Learn more about how DTAA works in our detailed guide: Understanding DTAA for NRIs.

Filing Requirements in India

Even though TDS is deducted, you must file an Indian income tax return if your total income in India exceeds the basic exemption limit (currently Rs 2.5 lakh for individuals below 60 years).

Filing returns allows you to claim refunds if excess TDS was deducted. Many NRIs get significant refunds because brokers deduct TDS at 20% or higher, but actual tax liability might be lower after claiming deductions and treaty benefits.

The due date for filing NRI returns is typically July 31st for the previous financial year. For assessment year 2024-25, you need to file by July 31, 2024 for income earned in FY 2023-24.

Get step-by-step guidance in our article on how to file NRI tax returns.

Reporting Requirements in Your Country of Residence

You must report your Indian investment income in your country of residence. Most countries require you to declare worldwide income, including earnings from foreign investments.

In the USA, NRIs must report Indian investments in FBAR (Foreign Bank Account Report) if their combined foreign account balance exceeds USD 10,000 at any time during the year.

FATCA (Foreign Account Tax Compliance Act) requirements also apply. Your Indian broker reports your account details to Indian tax authorities, who share it with the IRS under automatic exchange of information.

Failure to report foreign income and accounts can lead to heavy penalties in your country of residence. Consult a tax professional familiar with both Indian and your country's tax laws.

What are Common Mistakes to Avoid When Opening NRI Demat Account?

Learning from others' mistakes saves you time, money, and frustration. Here are the most common pitfalls.

Choosing Wrong Account Type

Many NRIs open NRO accounts thinking they'll save on paperwork, only to realize later they can't repatriate funds freely. If you invested foreign earnings, you'll regret not choosing an NRE account.

Conversely, some open NRE accounts and then invest Indian income like rental payments. This violates FEMA rules and can lead to account freezing or penalties.

Before choosing, clearly identify your fund sources and repatriation needs. If in doubt, consult with your broker or a tax advisor.

Incomplete Documentation

Submitting incomplete or unclear document copies is the number one reason for account opening delays. Blurry passport scans, expired address proofs, or missing visa pages cause back-and-forth with brokers.

Double-check every document before uploading. Ensure your address proof is recent (within 3 months), your PAN card is readable, and all passport pages are included.

Keep digital copies organized in a folder. You'll need to resubmit documents for KYC updates annually, so maintaining a good file system helps.

Not Linking Proper Bank Account

Some NRIs try to link resident savings accounts they previously had in India. This doesn't work. Your demat account must be linked only to NRI accounts (NRE or NRO).

Make sure the bank account type matches your demat account type. NRE demat needs NRE bank account, and NRO demat needs NRO bank account.

The linked bank account should be in your name individually. Joint accounts might not be accepted by some brokers, so clarify this upfront.

Ignoring Repatriation Rules

NRIs often realize too late that their NRO investments have annual repatriation limits. If you're planning to move large amounts abroad, not having an NRE account becomes a costly mistake.

Understand the USD 1 million annual limit for NRO accounts includes all repatriations, not just investments. If you're repatriating rental income or inheritance, that eats into your investment repatriation limit.

Overlooking Tax Implications

Many NRIs are shocked when they see 20% TDS deducted on their capital gains. Not knowing about DTAA benefits means paying more tax than necessary.

Factor in taxes when calculating expected returns. A 15% return on stocks becomes about 12% after LTCG tax, which is still good but different from your initial calculation.

Don't forget about tax filing requirements in your home country. Failing to report Indian income can lead to penalties that far exceed any gains you made.

Not Comparing Broker Charges

Choosing a broker based solely on brand name without comparing charges is expensive. The difference between 0.50% and 0.03% brokerage on Rs 10 lakh trades annually is about Rs 5,000-6,000.

Look beyond just brokerage. Factor in AMC, DP charges, call-and-trade fees, and any hidden charges. Calculate total annual cost based on your expected trading frequency.

How to Manage Your NRI Demat Account from Abroad?

Managing your investments from thousands of miles away requires good systems and practices.

Online Trading Platforms and Mobile Apps

Choose a broker with a robust mobile app that works flawlessly in your country. Test the app during market hours before committing to the broker.

Set up price alerts and notifications. Most apps let you set target prices, and you get notifications when stocks hit those levels. This helps you make timely decisions despite time zone differences.

Use the app's research and analysis tools. Many brokers provide technical charts, fundamental data, and news integration within the app. This reduces the need to switch between multiple platforms.

Power of Attorney Considerations

A Power of Attorney (PoA) allows your broker to debit shares from your demat account without requiring your manual authorization for each sale.

Without PoA, you need to manually authorize every sale transaction through CDSL Easiest or NSDL Speed-e. This can be inconvenient when you're in a different time zone.

However, granting PoA has risks. Your broker can potentially sell shares without your explicit consent. Only grant PoA to well-established, trustworthy brokers with strong regulatory track records.

Many NRIs prefer not giving PoA and instead use the Easiest/Speed-e facility for authorizations. It takes 2-3 extra minutes per sale but gives you complete control.

Account Maintenance Tips

Review your account statements monthly. Download and archive statements for tax filing purposes. You'll need them when claiming DTAA benefits or filing returns.

Update your contact information promptly when you change addresses or phone numbers. Many NRIs miss important communication because their registered email or phone is outdated.

Complete your annual KYC updates on time. Brokers are required to update client information annually. Failure to do this can lead to account freezing.

Monitoring and Portfolio Tracking

Use portfolio tracking tools integrated with your broker's platform. These show your overall returns, allocation across sectors, and dividend income in one place.

Set up automatic SIPs (Systematic Investment Plans) for mutual funds if you want to build wealth consistently. This removes the need to remember monthly investments and leverages rupee cost averaging.

Review your portfolio quarterly, not daily. Frequent checking leads to emotional decisions. As an NRI, you're investing for long-term wealth creation, not day trading.

What Happens to Your Demat Account if You Return to India?

Planning to return to India permanently? You'll need to convert your NRI accounts to resident accounts.

Converting NRI Demat to Resident Demat

Once you return to India and become a resident (stay more than 182 days in a financial year), you must inform your broker. Your residential status change affects your account type, tax treatment, and repatriation rights.

The broker will require proof of residential status change. This includes passport stamps, visa cancellation, employment termination from foreign employer, or any document showing your return to India.

Your existing investments remain in your demat account during conversion. There's no need to sell everything and start fresh. Only the account type and associated rules change.

For planning your return comprehensively, including financial considerations, read our guide: NRI return to India planning.

Process and Documentation

Submit a written request to your broker requesting conversion from NRI to resident demat account. Include your new residential address in India and updated contact details.

Provide fresh KYC documents showing resident status: Indian address proof, updated PAN card (if address changed), and a declaration of your current residential status.

Convert your NRE/NRO bank accounts to resident savings accounts. Your demat account must be linked to a resident bank account once you become a resident.

Timeline for Conversion

The conversion process typically takes 7-15 business days after submitting all required documents. This is faster than opening a new account since your existing KYC and investment history are already with the broker.

During the conversion period, you might face trading restrictions. Some brokers freeze the account temporarily until conversion completes. Plan accordingly and avoid having time-sensitive trades during this period.

Once converted, you get resident trading benefits: lower TDS rates on capital gains, no repatriation restrictions, and access to investment options not available to NRIs like PPF.

Impact on Existing Holdings

Your shares, mutual funds, and other holdings remain unchanged. The ISIN (International Securities Identification Number) of your securities stays the same, so there's no transfer or sale required.

However, any income earned after becoming a resident is taxed at resident rates. If you held shares as NRI and sold them after becoming resident, the tax treatment depends on when you purchased them.

Cost of acquisition for tax purposes remains the original purchase price. You don't need to mark-to-market your holdings at the time of conversion.

Conclusion

Opening an NRI demat account is your gateway to participating in India's economic growth from anywhere in the world. The key is choosing the right account type based on your fund sources and repatriation needs. NRE accounts work best if you're investing foreign earnings and want complete flexibility, while NRO accounts suit those investing Indian income.

Compare brokers carefully, looking beyond just brand names to actual charges, platform quality, and NRI-specific support. Get all your documents ready before applying to avoid delays. Most importantly, understand the tax implications and repatriation rules upfront to avoid surprises later.

Ready to start investing? Check out how different investment options compare to make informed decisions about your Indian investment portfolio.

Frequently Asked Questions

Can NRIs from any country open demat account in India?

Yes, NRIs from most countries can open demat accounts in India. However, citizens from countries identified as high-risk by FATF (Financial Action Task Force) might face additional scrutiny or restrictions. Some brokers may also have internal policies restricting certain countries. Always check with your chosen broker about country-specific restrictions before starting the application.

Do I need to visit India to open NRI demat account?

No, you don't need to visit India anymore. Most brokers now offer complete online account opening with video KYC (In-Person Verification through video call). You can complete the entire process from your country of residence. However, some traditional banks and brokers might still require physical document submission or in-person verification, so verify this beforehand.

Can I have both NRE and NRO demat accounts?

Yes, you can maintain both NRE and NRO demat accounts simultaneously if you have different sources of income. Use the NRE account for investing foreign earnings (fully repatriable) and the NRO account for investing Indian income like rental payments or freelance income earned in India. However, you'll pay AMC for both accounts, so consider if it's cost-effective for your situation.

What is PINS and do I need it?

PINS stands for Portfolio Investment Scheme. It's mandatory for NRE demat accounts but not required for NRO accounts. Under PINS, you register your investments with RBI through your broker, who acts as your custodian. If you're opening an NRE account for repatriable investments, your broker will handle PINS registration as part of the account opening process. You don't need to apply separately.

How much does it cost to maintain NRI demat account?

Costs vary by broker type. Discount brokers charge Rs 200-400 as account opening fees and Rs 0-300 as annual AMC. Full-service brokers charge Rs 500-1,000 for opening and Rs 500-750 as AMC. Additionally, you pay brokerage on trades (flat Rs 20 or 0.03-0.50% of transaction value), DP charges on selling (Rs 5-20 per scrip), and standard charges like STT and GST. Total annual cost for an active trader with a discount broker is typically Rs 2,000-5,000.

Can I transfer shares from resident to NRI demat account?

Yes, but it's a one-way street with restrictions. You can transfer shares from your old resident demat account to your new NRI demat account when you move abroad. However, the reverse (NRI to resident) requires RBI approval in most cases. Also, you cannot hold both resident and NRI accounts simultaneously. Once you become an NRI, close your resident account and transfer holdings to the NRI account. The transfer process takes 3-7 days and your broker can guide you through it.

How long does it takes to open NRI demat account?

The complete process takes 7-15 business days from application to account activation for most brokers. This includes document verification (1-3 days), video KYC scheduling and completion (1-2 days), account setup with depository (3-5 days), and bank account linking (2-3 days). Digital-first brokers like Zerodha can complete it in 24-48 hours if all documents are perfect. Traditional banks might take 15-20 days. International document courier adds 5-7 days if physical submission is required.

What if I lose my overseas residence status?

You must inform your broker immediately when you lose NRI status, either by returning to India or giving up your foreign residence. Your account needs to be converted from NRI to resident demat account within a reasonable timeframe (typically 30-60 days). Continuing to operate an NRI account after becoming a resident violates FEMA regulations and can lead to penalties or account freezing. The conversion process is straightforward and your broker will guide you through it.

About the Author

By Prakash

CEO & Founder of InvestMates

Prakash is the CEO & Founder of InvestMates, a digital wealth management platform built for the global Indian community. With leadership experience at Microsoft, HCL, and Accenture across multiple countries, he witnessed firsthand challenges of managing cross-border wealth. Drawing from his expertise in engineering, product management, and business leadership, Prakash founded InvestMates to democratize financial planning and make professional wealth management accessible, affordable, and transparent for every global Indian.